New Trustee Regulation in Switzerland

Trustee under FINIA: Scope and exemptions

Since entering into force of the Financial Institutions Act (FINIA) on 1 January 2020, trustees are subject to license from the Swiss Financial Market Supervisory Authority (FINMA) to conduct their business activities in Switzerland. Obtaining such license includes a number of requirements on a personal, financial and organizational level, which must be met by the trustee. Once having received a FINMA license, trustees are subject to supervision by supervisory organizations (SOs), authorized and supervised by FINMA. Trustees that were already operative as of 1 January 2020 can benefit from transitional provisions until 31 December 2022 at the latest to obtain such FINMA license.

a) Definition of trustee

A trustee under Art. 17 para. 2 FINIA is a person who on a commercial basis manages or holds a separate fund for the benefit of the beneficiaries or for a specified purpose based on the instrument creating a trust within the meaning of the Hague Convention of 1 July 1985 on the Law Applicable to Trusts and on their Recognition.

Commercial basis is defined in Art. 19 para. 1 of the implementing ordinance to FINIA (FINIO). Specifically, trustees are deemed to pursue their activities on a commercial basis and, within the meaning of anti-money laundering legislations, on a professional basis if they

- generate gross revenues of more than CHF 50,000 per calendar year;

- establish business relationships with more than 20 contractual parties per calendar year, each of which relationship is not limited to a one-off activity, or they maintain at least 20 such relationships per calendar year; or

- have unlimited power of disposal over assets belonging to others, which assets exceed CHF 5 million at any given time.

The third criterion, i.e. having unlimited power of disposal over assets belonging to others in excess of CHF 5 million at any given time, however, is only applicable to asset managers but not to trustees as in their capacity as trustees, they do own the assets.

b) Foreign trustees

Foreign trustees are affected by the FINIA if they are engaging in business in or from Switzerland (Art. 2 FINIO), either legally or factually, regardless of location of settlor, beneficiaries, assets of trust, etc. In addition, trustees not carrying out activities in or from Switzerland within the meaning of FINIA and FINIO, respectively, qualify as non-Swiss financial service providers that will need FINMA license if

- a branch exists in Switzerland which employs individuals, who on behalf of the non-Swiss financial service provider permanently and on a commercial basis acts as trustee (Art. 52 para. 1 lit. a FINIA); or

- individuals are active for them in any other manner on a permanent and commercial basis in Switzerland and are deemed as representatives (Art. 58 Abs. 1 FINIA).

As a result, foreign trustees with no permanent establishment in Switzerland are not within the scope of FINIA. Any foreign financial institution effectively managed from Switzerland must be organized in accordance with Swiss law and subject to the provisions governing domestic financial institutions (Art. 76 para. 2 FINIO). In case of a trustee not organized under Swiss law but effectively managed in Switzerland, however, such trustee would not be permitted to apply for a FINMA license, even though its business would be subject to licensing requirements.

c) Economic and family ties exemptions

In the FINIA and FINIO, certain exemptions from licensing requirements are available in case of activities for persons with economic or family ties, which do not count against the thresholds described under a) above.

Specifically, persons providing services exclusively to persons with whom they have economic ties are not within the scope of the FINIA (Art. 2 para. 2 lit. a FINIA). In line with Art. 3 FINIO, companies or units of a group are deemed to have economic ties insofar as they provide financial services or services in the capacity of trustee for other companies or units of the same group. In particular, not only parent companies, subsidiaries and affiliates benefit from this exemption but also pension funds, patronage welfare funds, foundations and charitable organizations and their investment vehicles if linked with the group. While such exemption is relevant in the context of group treasury operations, there will be only very limited practice for trust businesses in our view.

In addition, persons providing services exclusively to persons with whom they have family ties are not within the scope of the FINIA either (Art. 2 para. 2 lit. a FINIA). The following persons are deemed to have family ties with one another (Art. 4 para. 1 FINIO):

- relatives by blood or by marriage in the direct line;

- relatives by blood or by marriage up to the fourth degree in the collateral line;

- spouses and registered partners;

- co-heirs and legatees from succession until completion of the division of estate or allocation of the legacy;

- remaindermen (Nacherben) and residuary legatees in accordance with Art. 488 of the Civil Code;

- persons living in a long-term life partnership with a portfolio manager or trustee.

Further, pursuant to Art. 4 para. 2 FINIO, family ties are deemed to exist insofar as trustees manage in-house funds in favour of persons who have family ties with one another if the trustees are directly or indirectly controlled by:

- third parties who have family ties with these persons;

- a trust, a foundation or a similar legal construct set up by a person with family ties.

Such exemption applies as institutions with a public or not-for-profit purpose are also beneficiaries in addition to the persons with family ties (Art. 4 para. 3 FINIO). Specifically, the exemptions under Art. 4 para. 2 and 3 FINIO include private trust companies (PTCs) which are trust companies typically acting as trustee for trusts of one specific family only.

Finally, pursuant to Art. 9 para. 3 FINIO, exemptions from the duty to obtain a FINMA license as trustee can be granted to trustees which act exclusively as trustees for trusts which were established by the same person or in favour of the same family and which are held and monitored by a financial institution pursuant to FINIA or a licensed branch of a foreign financial institution. This type of dedicated trust companies is typically set-up for ring-fencing purposes and is not controlled by the family for the benefit of which the trust has been established but by a professional trustee or other type of financial institution pursuant to FINIA.

Corporate Governance (Art. 11 FINIA / Art. 13 FINIO)

Pursuant to Art. 11 para. 1 FINIA, a trustee and its board and executive management members must provide a guarantee of irreproachable business conduct (Gewährserfordernis). Moreover, board and executive management members of a trustee must enjoy a good reputation and have the specific qualifications required for their functions (fit and proper requirement; Art. 11 para. 2 FINIA). Qualified shareholders of a trustee, i.e. persons who directly or indirectly hold at least 10% of the share capital or the voting rights of the trustee or who can otherwise significantly influence its business activity, must enjoy a good reputation as well and ensure that their influence is not detrimental to prudent and sound business conduct.

For the assessment of the fit and proper requirements as described above, the following documentation must be provided to FINMA:

a) Individuals

- details of nationality, place of residence, qualified participations in financial institutions or other companies and pending court and administrative proceedings;

- curriculum vitae (signed);

- references;

- extracts from registers of convictions and debt collection office.

b) Entities

- articles of association;

- extract from commercial register or equivalent document;

- description of business activities, financial situation and, if applicable, the group structure;

- details of completed and pending court or administrative proceedings.

Further, at least two of the trustee's executive management members must have proper experience and qualification. A person is deemed qualified to manage trustee business operations if it has received appropriate training in the trustee business and at the time of assuming management duties has had sufficient professional experience within the framework of trusts. Specifically, a qualified manager of a trustee must pass the following test:

- five years of professional experience within the framework of trusts; and

- relevant training of at least 40 hours within the framework of trusts.

FINMA can grant exemptions from these requirements based on legitimate grounds, however, trustees must engage in regular ongoing professional development of maintaining the skills acquired.

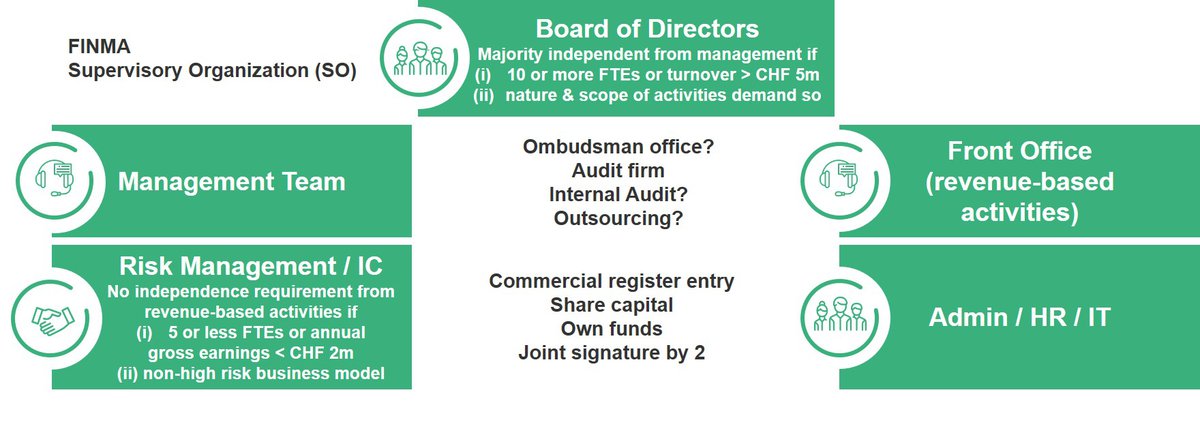

Trustee Organization

Risk management/Internal Control

Financial service providers including trustees must identify, measure, control and monitor their risks, including legal and reputational risks, and organize effective internal control (Art. 9 para. 2 FINIA). Specifically, trustees must have both an appropriately defined risk management system as well as an effective internal control structure in place to ensure, among other requirements, compliance with legal and internal provisions. The risk management and internal control function can either be carried out by a qualified manager or delegated to one or more suitably employees or outsourced to an external provider (Art. 21 para. 1 and 2 FINIA). Risk management and internal control functions are not required to be independent of revenue-based activities if the trustee:

- is a company which has 5 or fewer FTEs or annual gross revenues of less than CHF 2 million; and

- adheres to a non-high-risk business model.

If the trustee generates annual gross revenues of more than CHF 10 million, FINMA may also require the appointment of an internal audit function independent from management of the trustee.

a) Outsourcing/delegation of tasks

Trustees can delegate tasks to external third-party providers if they have the necessary skills, knowledge and experience as well as the required authorizations to conduct such activities. Tasks are deemed delegated if the financial institution appoints a service provider to independently and permanently perform, in full or in part, a material task, thereby changing the circumstances of the FINMA authorization. Despite Art. 15 para. 2 FINIO, material tasks not only include the services described in Art. 19 FINIA but also risk management and compliance function, outsourcing of data processing systems containing client relevant data, etc.

When outsourcing certain functions, trustees remain responsible for the fulfilment of supervisory duties and when delegating these tasks, they must safeguard the clients' interests. In particular, they must agree with the third party in writing which tasks are to be delegated and define

- the authorities and responsibilities;

- any powers of sub-delegation;

- the third party's duty to render account;

- the trustee's rights of control.

As any outsourced function including possibility of sub-delegation must be described in the organizational regulations of the trustee, any change related to the outsourced function requires prior FINMA approval. Delegation must be defined and organized in a way that the trustee, its internal auditors, the audit firm, the SO and FINMA are able to inspect and review the delegated tasks (Art. 17 FINIO).

b) Supervisory Organization

Before obtaining a FINMA license, trustees must register with a SO for prudential supervision purposes. A SO is responsible for ensuring compliance of trustees with FINIA licensing requirements. The SO itself is licensed and supervised by FINMA. The FINMA has already granted the first licenses for SOs. Further, SOs will recognize audit firms that will undertake the regulatory audits of the trustees.

c) Ombudsman Offices

The Federal Department of Finance (FDF) recognized the first ombudsman’s offices according to the Financial Services Act (FINSA) with effect from 24 June 2020. Unlike the self-regulatory ombudsman system of the past for banks, under the FINSA, affiliation to an ombudsman’s office has become mandatory for all financial institutions that provide their services in Switzerland (Art. 16 para. 1 FINIA). Furthermore, the ombudsman’s offices must be recognized by the FDF. As in the past, the ombudsman’s offices should settle disputes regarding legal claims between clients and financial service providers in mediation proceedings. In accordance with the FINSA, financial institutions in the sense of Art. 16 para. 1 FINIA must affiliate themselves to such an ombudsman’s office within six months of the first ombudsman’s office being recognized, i.e. by 23 December 2020 at the latest.

On 10 September 2020, however, the Swiss Parliament revised Art. 16 para. 1 FINIA in the sense that only financial institutions that provide financial services under Art. 3 lit. c FINSA must affiliate with an ombudsman office. This is good news for trustees as they will no longer be required to affiliate with an ombudsman office under the revised Art. 16 para. 1 FINIA. At this point in time, it is unfortunately unclear when the revised legislation will enter into force. From a strictly legal point of view, trustees would be obliged to affiliate with an ombudsman office on a temporary basis until the revised Art. 16 para. 1 FINIA has entered into force. Rumors say that FINMA will not impose sanctions on those trustees not affiliating with an ombudsman office meanwhile, however, to have legal certainty, we would expect at least an official statement of FINMA in this respect.

Licensing Requirements

The minimum capital of trustees must amount to CHF 100,000, fully paid-in in cash (Art. 22 para. 1 FINIA) and must be complied with at all times. In addition, trustees must have adequate collateral or take out professional liability insurance. Level of capital adequacy must at all times amount to at least 25% of the fixed costs reported in the most recent annual financial statement but not more than CHF 10 million (Art. 23 para. 2 FINIA). The following are fixed costs pursuant to Art. 23 para. 2 FINIA:

- staff costs;

- operating business costs;

- depreciation of investment assets;

- expenses for valuation adjustments, provisions and losses.

The portion of staff costs which solely depends on the business result or in relation to which no legal entitlement exists including bonuses must be deducted from staff costs.

Legal entities may count the following as qualifying capital:

- Paid-up share and participation capital in case of a company limited by shares, the nominal capital in case of a limited liability company and the cooperative capital in case of a cooperative;

- general statutory and other reserves;

- retained earnings;

- net profit for the current financial year after deduction of the estimated share in the profit distribution, provided an audit review or an audit pursuant to the Code of Obligations of the interim or the annual accounts confirms the assurances stipulated;

- hidden reserves, provided they are assigned to a separate account and designated as capital and their qualification as such is confirmed on the basis auf the audit in accordance with Art. 62 FINIA.

Further, any loans including bonds with a maturity of at least five years, count as qualifying capital as well if a declaration is provided to the effect that:

- in the event of liquidation, bankruptcy or probate proceedings, such loans shall be subordinate to the claims of all other creditors; and

- the trustee undertakes neither to net such loans with its own claims nor the secure them with its own assets.

When calculating the level of capital adequacy, certain deductions may be made in line with Art. 30 FINIO including, but not limited to the loss carried forward and the loss for the current financial year. Insofar professional indemnity insurance covers the risks entailed by the business model, it may be counted 50% towards the qualifying capital.

When applying for a FINMA license, solid capital adequacy is vital.

Regulatory Duties

Within the framework of the law applicable to the trust, trustees must act in the best possible interests of beneficiaries and with the required level of skill, care and diligence. Further, they must take appropriate organizational precautions to avoid conflicts of interest or disadvantages for beneficiaries as a result of conflicts of interest (Art. 24 para. 4 FINIO). Different from portfolio managers, a trustee has no regulatory obligation to hold trust assets on separate accounts as long as the bank or securities firm allocates the assets to each individual client. Also, the obligation to take measures to avoid a break-off of contact with clients and the prevent client relationship from becoming dormant does not apply to trustees either.

Whether the Financial Services Act (FINSA) is applicable to trustees as well depends on the services provided by the trustee. Specifically, if the trustee is providing only trust services within the meaning of Art. 17 para. 2 FINIA, i.e. the management by a trustee of investments held in trusts under its administration, the trustee is not within the scope of the FINSA because it is not providing a financial service pursuant to Art. 3 lit. c FINSA. On the flip side, however, a trustee as recipient of financial services within the meaning of FINSA will still be affected by FINSA.

Timeline and Next Steps/Need for Action

Obtaining a FINMA license can be challenging. We observed through the years that many applicants for a FINMA license were struggling either when applying or after having received the license just because they were not fully aware what the licensing requirements really mean. As a first step, we strongly recommend that any trustee critically review its current business model and organization and compares it to the FINIA trustee licensing requirements. For example, what are the financial obligations? How should the corporate governance structure of the trustee look like, etc.?

Further, any trustee should be aware of the costs of obtaining and maintaining a FINMA license. The contemplated organizational structure needs to be checked against the FINIA requirements on level of the trustee itself, its qualified shareholders, board members and all other relevant functions. Internal working processes need to be reviewed and formalized including a set of internal guidelines, which are to the point. This process will take time, and especially for institutions not yet subject to prudential supervision, obtaining a FINMA license will be a major achievement.

In our experience, licensing processes with FINMA are time-consuming mainly due to insufficient documentation of license application so that FINMA must request further details. It is therefore vital to have a well-drafted, concise application.

In terms of timing, the notification duty of existing trustees to FINMA has expired on 30 June 2020. They must comply with the legal requirements and submit an application to FINMA by 31 December 2022 at the latest. Trustees will be permitted to continue their activities until FINMA's decision on the license provided that they are affiliated to a self-regulatory organization for anti-money laundering purposes.

What will be the best timing for the filing of a license application for a trustee? By 30 June 2020, FINMA has received notifications from 1,934 portfolio managers and 272 trustees who are interested in a license. As you can imagine, a number of these institutions is not in a hurry about obtaining such new license. However, our experience with managers of collective investments has shown that the development of the FINMA practice regarding interpretation of licensing requirements has evolved over the years, which brings us to the conclusion that a filing as an early mover can have advantages as well. Also, we expect that FINMA will be much more busy in two years than these days, based on the number of notifications received by 30 June 2020.

No legal or tax advice

This legal update provides a high-level overview and does not claim to be comprehensive. It does not represent legal or tax advice. If you have any questions relating to this legal update or would like to have advice concerning your particular circumstances, please get in touch with your contact at Pestalozzi Attorneys at Law Ltd. or one of the contact persons mentioned in this Legal Update.

© 2020 Pestalozzi Attorneys at Law Ltd. All rights reserved.