Have you heard about the proposed Swiss paying agent tax?

Key takeaways

- The changeover to the paying agent principle does mean that customers must be newly classified and that paying agents’ IT systems must be adapted.

- Investors resident outside Switzerland and legal entities resident in Switzerland shall be exempt from withholding tax on interest, in particular interest from bonds.

- Introduction of a paying agent tax for domestic and foreign interest income if a natural person with tax residence in Switzerland earns interest through a Swiss paying agent.

- The proposed paying agent tax would be levied also on indirect interest income such as e.g., certain income items derived from structured products or interest income items collected by fiscally transparent domestic and foreign distribution and accumulation investment funds.

- No changes are envisaged to withholding tax on interest from loan receivables of creditors outside Switzerland against borrowers in Switzerland, where Swiss withholding tax is triggered only because the loan receivables are secured by security interests in Swiss real property.

- Nothing is changing with regard to income from dividend distributions.

What are the planned changes?

Investors resident outside Switzerland and investors in the form of a legal entity resident in Switzerland shall be exempt from withholding tax on interest, in particular interest from bonds. (learn more in our legal update of 16 July 2019)

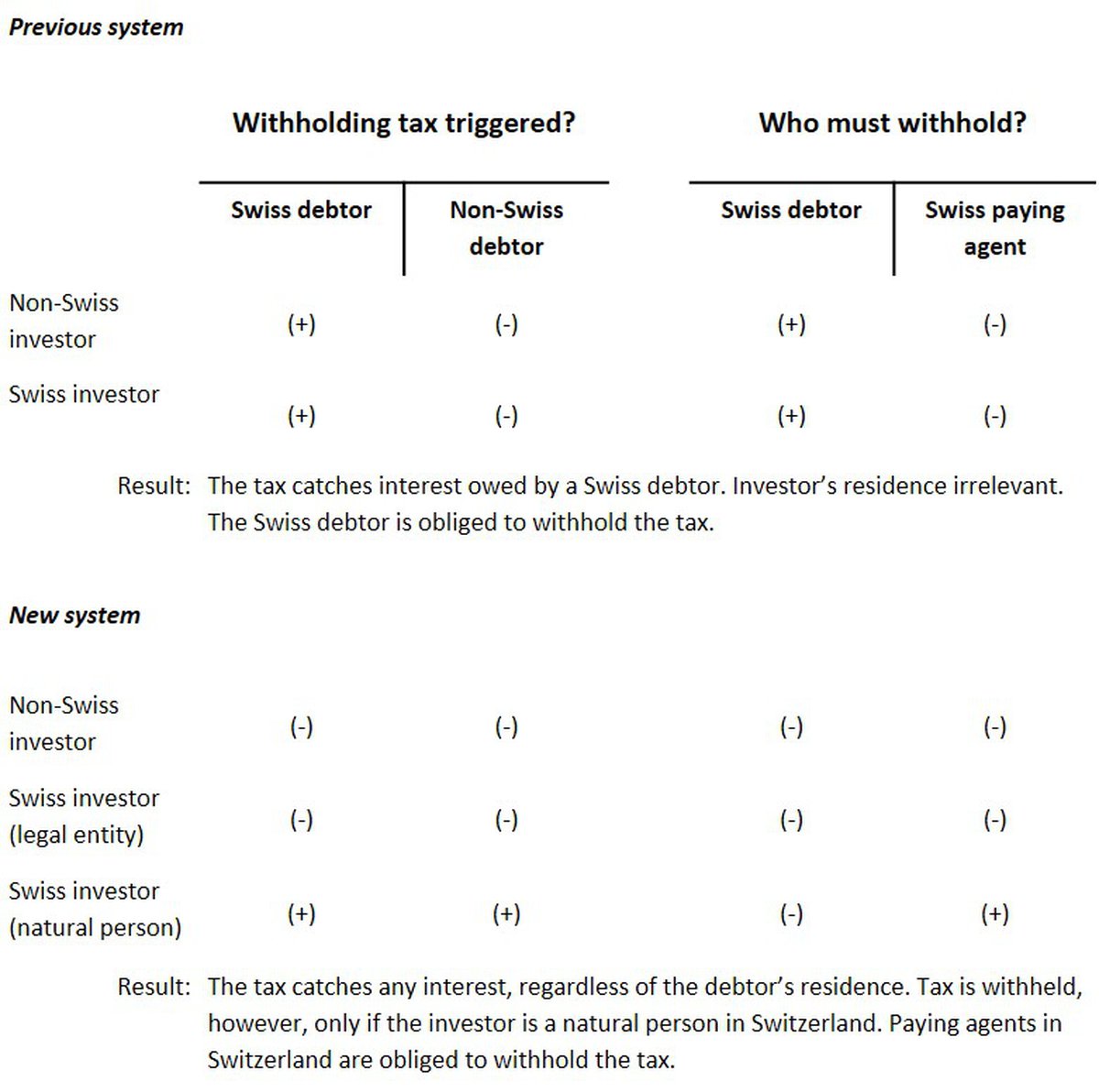

Furthermore, no longer will the Swiss debtor of the interest-bearing instrument levy a withholding tax on the interest income but rather the paying agent in Switzerland. This switch in levying responsibility is a genuine system change as regards the levying of Swiss interest withholding tax, namely from the debtor principle to the paying agent principle.

This, however, will include only interest income of beneficial owners who are natural persons and tax resident in Switzerland. At the same time, interest income will now be included, regardless of the interest debtor’s domicile (Switzerland or other countries). The main difference between the debtor and paying agent principles is that, under the debtor principle, withholding tax can be levied only on interest accruing on a debt instrument that a debtor resident in Switzerland issues, whereas, under the paying agent principle, Switzerland is also able to levy withholding tax on interest owed on securities issued outside Switzerland.

The tax rate will remain unchanged at 35%.

No changes are envisaged to withholding tax on interest from loan receivables of creditors outside Switzerland against borrowers in Switzerland, where Swiss witholding taxs is triggered only because the loan receivalbes are secured by security interests in Swiss real property.

Also, no changes are envisaged to investment income (i.e., income from dividend distributions), to which the debtor principle will continue to apply.

For paying agent tax to be levied in the future, the following requirements must therefore be met:

- There must be an income item classed as relevant "interest" income;

- A paying agent in Switzerland must be involved; and

- The beneficial owner must be a natural person with tax residence in Switzerland.

If the paying agent is located outside Switzerland, then the AIA legislation governs.

The following questions in particular come up in relation to a changeover to the paying agent principle:

When is income classed as relevant interest income?

The paying agent tax will apply not only to classic direct interest income ("% x directly held reference value") but also to so-called "indirect" interest income. This issue will likely be fleshed out further over the course of the legislative process. For example, even income deriving from structured products or income from investment fund units could be affected by the interest withholding tax as "indirect" interest.

When it comes to Swiss tax law, these judgements are not entirely new. One example can be products for which the underlying for income from the product consists of interest. Also, the approach the Swiss tax authorities currently take is that products that, for example, have capital protection may contain a bond-like component and, therefore, interest-like income components.

Also, as regards investment funds, the idea of differentiating according to source of income within the fund assets is not fundamentally new in Swiss taxation practice. For example, from the perspective of natural persons resident in Switzerland as investors in fiscally transparent funds, the question already exists whether the fund income was derived from capital gains (then the investor is exempt from income tax for that income) or from other sources (on which the fund investor is liable for income tax). Current fund reporting rules do not, however, require that interest income be carved out from other taxable income such as e.g., dividend income.

Is the beneficial owner a natural person?

Parallels may be drawn with the previous EU/Switzerland agreement on the taxation of interest (since replaced by the AIA). The EU/Switzerland agreement on the taxation of interest applied to interest income whose beneficial owner was a natural person (resident in the EU).

Formerly, for example, the "insertion" of a legal person could result in no withholding tax having to be deducted, although it did still need to be borne in mind that tax evasion may still have taken place or that the paying agent had to carry out adequate investigations to determine who the beneficial owner actually was. Similar questions were, for example, posed under the EU/Switzerland agreement on the taxation of interest in connection with partnerships or trusts.

Who is a Swiss paying agent?

In the paying agent tax system, the paying agent obliged to levying the tax must be legally defined. Again, this subject is not entirely new and, in fact, similar questions were asked when the previous EU/Switzerland agreement on the taxation of interest was in force. Banks are definitely affected if the customer is booked in Switzerland. Fund management companies, in particular, however, where fiscally transparent accumulation investment funds are concerned, may also be eligible as paying agents.

Under current practice, fiduciary investments that a bank in Switzerland places in its own name but on the account and at the risk of a bank customer with a foreign counterparty are deemed not customer balances with a bank in Switzerland. Therefore, as long as the relevant practice criteria are adhered to, such investments can be made under the current debtor principle without Swiss interest withholding tax being deducted. The same generally applies to interest-bearing investments of bank customers – including bank customers from Switzerland – at branch offices of Swiss banks outside Switzerland. Practice rules currently exist, as anti-abuse conditions, for the repatriation of such funds within the bank. With regard to such investment structures, the changeover to the paying agent principle raises the question whether or under what circumstances may Swiss interest withholding tax need to be levied.

What happens when there is no (full) cash payment for interest income?

On occasion, despite ("indirect") interest income, there may not be a (complete) corresponding payment flow (from the instrument) to the investor who is the beneficial owner. This situation may, for example, occur when financial instruments, with accrued interest components, are transferred or in the event of debt conversion. Fiscally transparent accumulation investment funds could be another example. Ongoing discussions focus on whether the paying agent tax should even apply to these cases and, if so, in which process.

How is the tax assessment basis determined?

In particular, regarding foreign interest income, the question here is how to determine the assessment basis. This question becomes especially relevant if interest income is subject to withholding tax under local foreign tax law. If so, then the next question becomes is it the gross or net interest income that will be the basis for levying the Swiss paying agent tax. In this case also, parallels could be drawn with the previous EU/Switzerland agreement on the taxation of interest (already replaced by the AIA), in which the basis was the gross interest income.

Deduction of paying agent tax, as of a relevant key date, may represent another problem area in determining the assessment basis. Where products such as investment funds, structured products, etc. are concerned, the paying agents would need to have up-to-date information from the parties issuing the products.

What liability risks are associated with collecting the tax?

It is proposed that the paying agent will be responsible for correct collection and payment of the tax and, should the paying agent fail to pay the tax on time, the paying agent will also be liable for late payment interest. Criminal liability would arise only in the event of intent.

Need for Action - when will the changeover to the paying agent principle be implemented?

Currently, only key aspects of the tax reform have been drawn up. Thus, the tax reform could not conceivably be implemented until 1 January 2022 at the earliest. The changeover to the paying agent principle does, however, mean that customers must be newly classified and that paying agents’ IT systems must be adapted. These adaptations in question will take time, resources, and money. Large firms, for organizational reasons, have prolonged internal advance notice periods, sometimes 6 months, for making modifications to their IT systems and, as such, the firm cannot become compliant with any great speed. And before any IT programming can be made, a necessary assessment of both what relevant interest is as well as who the paying agent is must be done. Thus, considering all this, further developments to the reform will need to be monitored closely.