COVID-19: Changes in operation of courts and public administration

On 16 March 2020, the Swiss Federal Council declared an extraordinary situation pursuant to the Epidemics Act. Public administrations and courts have adapted their opening hours and operation to the current situation. Time limits in civil and administrative proceedings are temporarily suspended.

Key takeaways:

- Civil and administrative proceedings as well as debt enforcements are suspended until 19 April 2020.

- Postal deliveries could be delayed and deliveries to certain countries are currently impossible.

- Many authorities remain in operation, but have limited their opening hours and adapted their operation to the current situation.

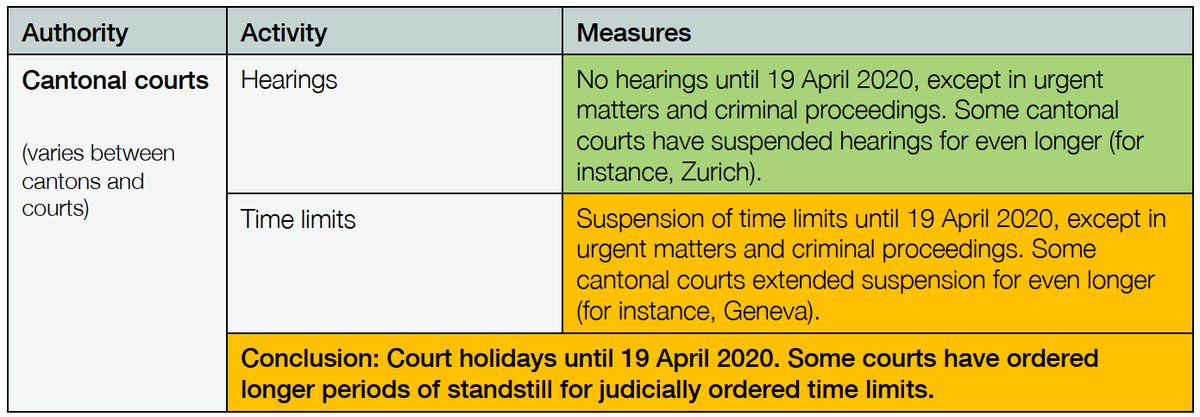

Court holidays until 19 April 2020

In the Ordinance on the standstill of time limits in civil and administrative proceedings for the upholding of the judiciary system in relation to coronavirus (COVID-19) of 20 March 2020, the Federal Council extended the judicial holidays and suspended time limits during the period from 21 March until 19 April 2020.

In principle, all civil and administrative proceedings before courts and authorities are affected. This measure applies to statutory time limits as well as to time limits ordered by a court or authority. The effects of the suspension of time limits are governed by the relevant procedural law (for instance, no court hearing during this period, and time limits start to run on the first day following the end of the suspension of service if effected during this period).

The suspension does not affect procedures for which court holidays do not apply. This is notably the case in urgent matters, in conciliation proceedings and in criminal procedures.

Changed opening hours

A number of public administrations have closed their counters or limited their opening hours. If a visit on site is unavoidable, the current opening hours should be checked in advance. Many services can also be provided by postal delivery, email, telephone or online. However, it is expected that public administrations’ services will generally take more time during COVID-19 due to staff shortages.

Operation of Swiss Post and selected public administrations

Swiss Post

The Swiss Post is limiting its services during the Federal Council's measures. Certain post offices will remain closed or have limited the opening hours of their counters. Anyone sending legally relevant correspondence, such as the reminder for payment or the termination of a contract, by postal delivery may face a delay in delivery. International postal deliveries to certain countries are currently not possible at all.

When delivering registered mail, a postal employee will sign for the person authorised to receive mail. Should the person authorised to receive the mail not be able to accept registered mail or collect it from the post office due to quarantine restrictions or other health protection measures, authorised third parties may also collect the registered mail. For this purpose, a corresponding power of attorney has to be deposited with the Swiss Post.

Cantonal courts

The measures taken by the cantonal courts may go beyond the recommendations of the Federal Council. Several courts have already taken further measures. For example, the Geneva Civil Court has extended all judicial time limits that expire before 10 May 2020 until 25 May 2020. In the canton of Zurich, courts have suspended all hearings until 26 April 2020. In light of the different measures applied by cantonal courts, it is advisable to find out in advance about individual measures taken by the various relevant courts.

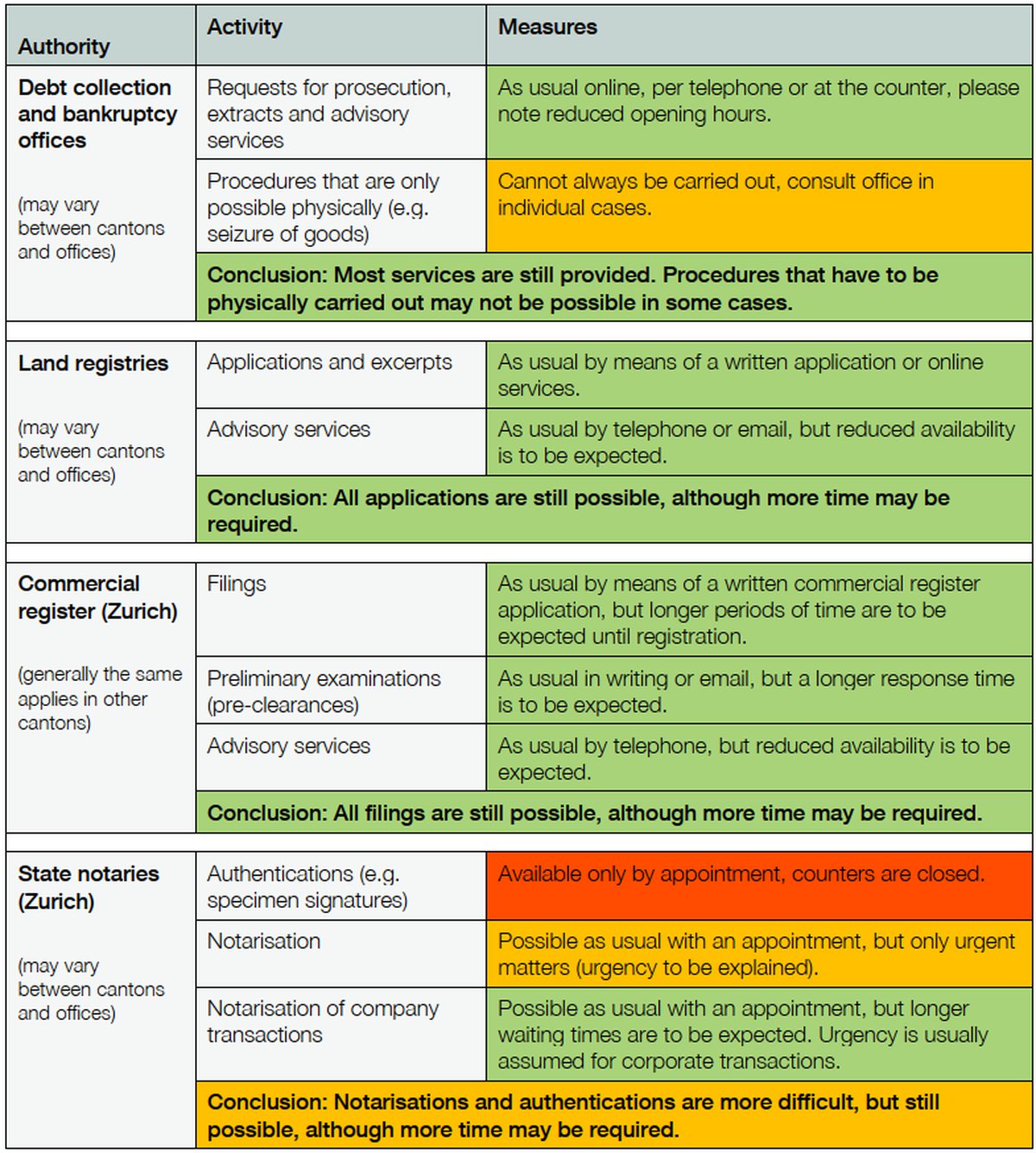

Debt enforcement

Debt enforcement actions and service of debt enforcement documents have been stopped until 19 April 2020 (see our legal update of 20 March 2020).

Land registry, commercial register and state notaries

Debt collection and bankruptcy offices have closed their counters or limited their opening hours. The counters of the land registry and the commercial register will be temporarily closed. Furthermore, it is to be expected that state notaries will be less flexible with regard to appointments for public authentication. Most authorities remain available via email or telephone. Many services are also offered online.

Effect on corporate transactions

Corporate transactions such as incorporations, capital increases or mergers etc. are still possible as usual, but the time required for pre-clearances and/or the registration in the commercial register to take legal effect may take longer than usual.

Local tax offices

It is expected that more and more local tax offices will extend the general filing deadlines for the annual income tax returns. Inter alia, the cantons of Zurich, Fribourg, Geneva and Aargau have already done so and they have extended the filing deadlines for individuals (new extended filing deadlines: Zurich, Geneva and Aargau 31 May 2020; Fribourg 30 June 2020). In these cases, it is not necessary to make an individual application –the deadline extension applies generally. Further measures are expected to be announced in the next few days.

Tax payment relief mechanisms (deferral of payment, payment in instalments) or tax waivers are available for corporate income tax and VAT. According to the ordinance and the information letter recently published by the Swiss Federal Tax Administration (SFTA), the Swiss government will not grant automatic or simplified tax payments relief; however, the SFTA recommends that requests for tax deferrals and instalment payments be treated favourably. Payment relief is available interest-free from March 2020 until (initially) 31 December 2020 for VAT and federal corporate income taxes. However, for federal corporate income taxes, interest-free tax deferrals are only available for taxes due in the same period (1 March until 31 December 2020). In addition, the nationwide suspension of debt enforcement until 19 April 2020 applies even if no formal payment deferral was granted.

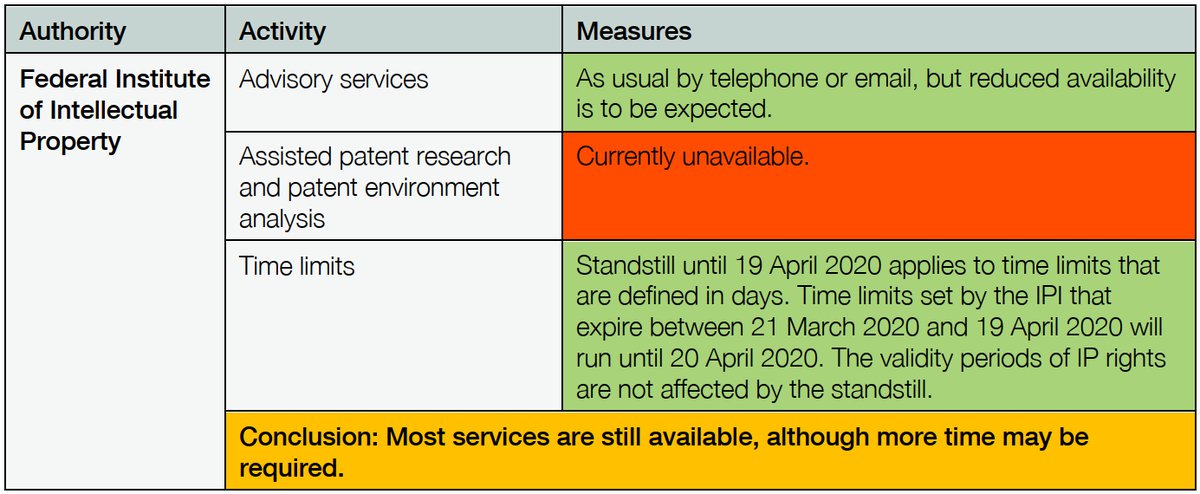

Federal Institute of Intellectual Property (IPI)

The Federal Institute of Intellectual Property (IPI) remains closed to the public for the time being. Applicants and holders of rights who are threatened with procedural disadvantages due to COVID-19 will receive continued support from the IPI. With regard to requests for extensions of time limits, the IPI will also grant an extension of two months for the first and second extension of a time limit. If important reasons are at hand, a third extension for an appropriate period of time may be granted.

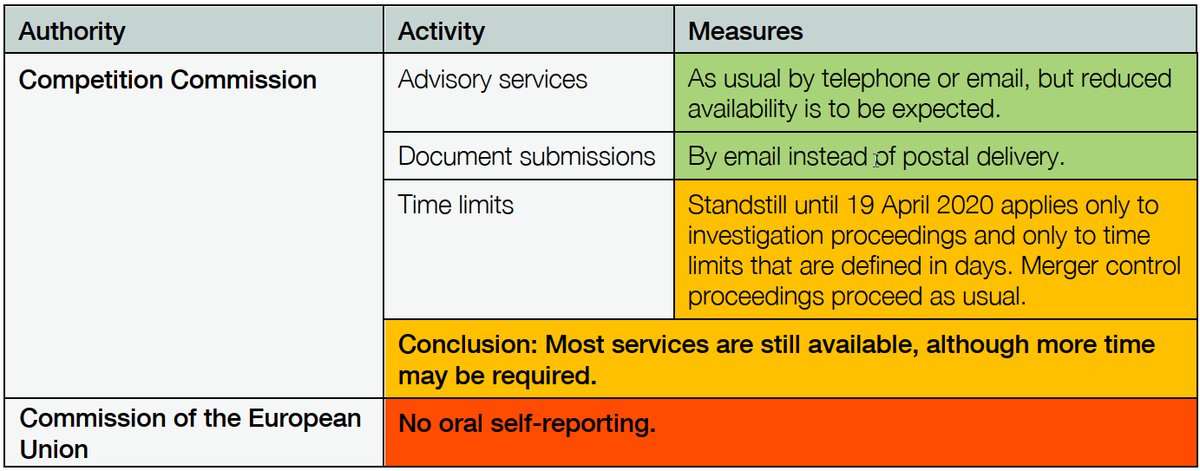

Competition Commission (COMCO) and Commission of the European Union (DG Competition)

In investigation proceedings before the Competition Commission (COMCO), the rules on the standstill of time limits during the judicial holidays apply to the undertakings involved as of 21 March 2020. Merger control proceedings, on the other hand, will proceed as usual and COMCO needs to handle them within the usual statutory time limits. Legal advisors working from home may submit documentation by email instead of postal delivery. Oral self-reporting to the Commission of the European Union to apply for leniency is temporarily not possible. COMCO has not made a comparable announcement.

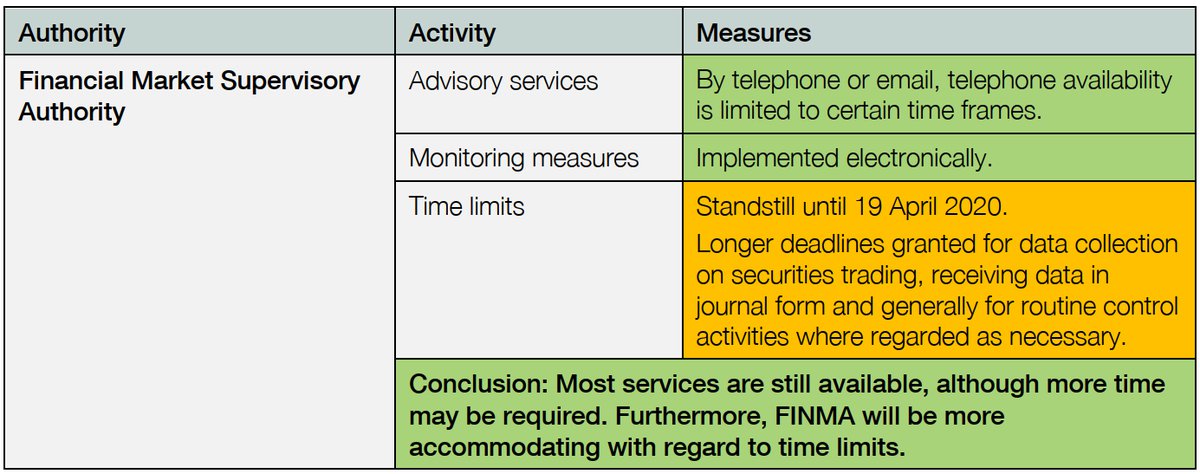

Swiss Financial Market Supervisory Authority (FINMA)

The Swiss Financial Market Supervisory Authority (FINMA) is only available by telephone or email. FINMA will interpret regulations relating to the physical and electronic environment of a trading venue in such a way that work from home is broadly possible. The necessary monitoring measures can largely be implemented electronically. FINMA will also grant institutions longer deadlines when collecting data on securities trading. FINMA will not insist on receiving data in journal form within three working days. In addition, FINMA is willing to postpone certain deadlines and routine control activities in order to allow the affected institutions to deploy their capacities more freely.

Contributors: Severin Etzensperger (Associate), Daniela Fritsch (Associate), Pascale Schwizer (Associate), Roger Felder (Junior Associate)

No legal or tax advice

This legal update provides a high-level overview and does not claim to be comprehensive. It does not represent legal or tax advice. If you have any questions relating to this legal update or would like to have advice concerning your particular circumstances, please get in touch with your contact at Pestalozzi Attorneys at Law Ltd. or one of the contact persons mentioned in this Legal Update.

© 2020 Pestalozzi Attorneys at Law Ltd. All rights reserved.