Swiss Voters Reject Federal Estate Tax Initiative with an overwhelming majority: What This Means in Practice

Key takeaways

- No new federal estate tax: Swiss voters clearly rejected the “Future Initiative”; the existing system with cantonal inheritance and gift taxes remains in place.

- The initiative proposed a 50% federal estate and gift tax on the portion of estates and lifetime gifts exceeding CHF 50 million, in addition to cantonal and municipal inheritance taxes.

- The outcome underscores Switzerland’s preference for legal and tax stability, which is a key factor for entrepreneurs, family businesses and high-net-worth individuals.

- Switzerland’s existing framework remains highly attractive: two cantons do not levy any estate, inheritance or gift taxes at all, and in most cantons transfers to spouses and direct descendants are fully exempt. This makes Switzerland a particularly competitive jurisdiction for intergenerational wealth and succession planning.

Introduction

On 30 November 2025, Swiss voters clearly rejected the “Future Initiative” on the introduction of a federal estate tax.

With over 78% voting against the proposal, the Swiss electorate has once again confirmed its scepticism towards far-reaching changes to the current tax framework for private wealth and succession planning. The result was surprisingly clear, and the proposal did not receive a majority in any of the 26 cantons.

The vote attracted significant attention both domestically and internationally, as it touched on high-value estates and the broader question of how to fund climate-related public spending. Against this background, we have summarised below what was actually at stake, how the proposed tax would have worked in practice, and what the outcome means for Switzerland’s attractiveness as a place to live and invest.

What was the vote about?

Swiss voters were asked to decide on the “Future Initiative”, which proposed the introduction of a federal estate tax. The initiative aimed to levy a 50% federal estate and gift tax on the portion of estates and lifetime gifts exceeding CHF 50 million, with the goal of financing climate measures.

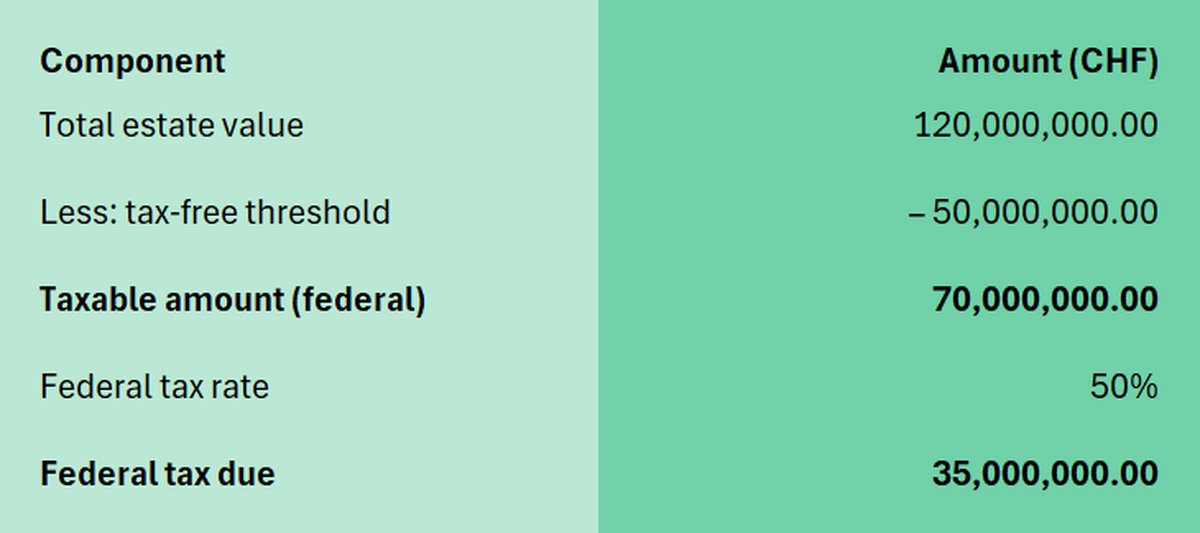

How would an estate of CHF 120 million be taxed under the proposed federal initiative?

The initiative proposed a flat tax rate of 50% on estates and lifetime gifts that exceed a one-time, tax-free threshold of CHF 50 million.

Calculation of the proposed federal tax:

This federal tax would have been levied in addition to existing cantonal and municipal inheritance taxes. However, in most Swiss cantons, transfers to direct descendants (children) and spouses are currently exempt from cantonal inheritance and gift tax.

Does this mean Switzerland is becoming less attractive?

No. The extremely clear rejection of the initiative underlines Switzerland’s continued preference for legal and tax stability, which remains a key element of Switzerland’s attractiveness for entrepreneurs, family businesses and high-net-worth individuals. The Federal Council and both houses of parliament had recommended rejecting the initiative.

Switzerland maintains its existing, internationally highly competitive cantonal framework, where two cantons do not levy any estate, inheritance or gift taxes at all, and in most cantons transfers to spouses and direct descendants are fully exempt from such taxes.

What is next?

For the time being, no immediate action is required. Nevertheless, wealthy individuals and families should continue to monitor political developments and periodically review their succession and estate planning structures to ensure they remain robust and up to date.

From a broader fiscal policy perspective, the room for manoeuvre in public finances is likely to remain tight at both federal and cantonal level, not least due to demographic trends, investment needs and climate-related spending. General tax increases or adjustments to other parts of the tax system therefore cannot be excluded over the medium to longer term.

However, the very clear rejection of the Future Initiative sends a strong signal away from estate, inheritance and gift taxes as a preferred financing tool. Not a single canton (and only 2 out of over 2100 municipalities) recorded a majority in favour of the proposal, which makes more restrictive inheritance or gift tax regimes at cantonal or municipal level unlikely in the foreseeable future.

At the same time, the vote underlines Switzerland’s strong preference for continuity and predictability in the taxation of private wealth and succession. While the public debate around a federal inheritance tax may have been unsettling and arguably harmful to Switzerland’s reputation, the outcome demonstrates that the country remains a particularly stable and reliable jurisdiction in this area when compared internationally.

Do I need to take any action now?

Irrespective of this particular vote, it remains important to ensure that wills, marriage and inheritance contracts, shareholder agreements and holding structures are aligned and periodically reviewed from a tax and civil-law perspective. If you would like to discuss your specific situation, how the political debate around inheritance taxation may affect your personal or family circumstances, or if you are considering a relocation to or within Switzerland, our tax team will be pleased to assist you.

Authors: Remo Keller (Partner), Camilo Otalora (Associate)

No legal or tax advice

This Legal Update provides a high-level overview and does not claim to be comprehensive. It does not represent legal or tax advice. If you have any questions relating to this Legal Update or would like to have advice concerning your particular circumstances, please get in touch with your contact at Pestalozzi Attorneys at Law Ltd. or one of the contact persons mentioned in this Legal Update.

© 2025 Pestalozzi Attorneys at Law Ltd. All rights reserved.