Impact of Dodd-Frank on Swiss financial institutions in the light of the Volcker Rule and the OTC derivatives reform

- Restrictions on proprietary trading

- Distinction between swaps and non-swaps

- Swiss entities can fall within Dodd-Frank, but are – under certain circumstances – excluded

The goal of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act (DFA)), signed into law in July 2010, is to prevent another significant financial crisis by creating new financial regulatory processes that enforce transparency and accountability while implementing rules for consumer protection. Non-US-Persons like Swiss financial institutions are, to some extent and under certain circumstances, also subject to DFA-rules. Two key parts of the DFA for such financial institutions are the so called "Volcker Rule" (DFA § 619) (see section 3 below) and the over-the-counter OTC derivatives reform (DFA Title VII) (see section 4 below). Five years on, significant progress has been made in implementing the key elements of Dodd-Frank. The aim of this overview is an introduction in the mechanics and terminology of the Volcker Rule and DFA Title VII as well as its impact on Switzerland. Generally Swiss market participants and the Swiss trading business are not necessarily a target of Dodd-Frank, but – under certain circumstances – Swiss entities fall under its rules and are therefore obliged to comply with Dodd-Frank.

1. Background

Under the DFA, the following shall be achieved:

- Improvement of consumer protection;

- Guarantee of transparency of OTC derivatives;

- Risk mitigation in the financial system; and

- Capital standards and regulation of systemically relevant financial institutions.

During the lenghy implementation period, many rules have been reproposed and amended, such as the most recent cross-border security-based swap rules regarding activities in the U.S.

2. Key highlights of the Dodd-Frank Act

With the complete implementation of the DFA, swap dealers will be subject to robust oversight.

Standardized derivatives will be required to trade on open platforms and be submitted for clearing to central counterparties.

The Dodd-Frank Act has brought and brings comprehensive reform to the regulation of swaps (these products, which have not previously been regulated in the United States, were at the center of the 2008 financial crisis).

On an entity level the following obligations will enter into effect:

- Increased capital requirements;

- Risk management;

- Record keeping;

- SDR reporting;

- Larger trade reporting; and

- Appointment of a Chief Compliance Officer.

On a transaction level the following new features will govern the relevant trades:

- Mandatory clearing;

- Reporting;

- Daily trading records;

- External business conduct standards;

- Trade confirmation;

- Swap trading relationship documentation;

- Margin and segregation; and

- Execution.

3. Volcker Rule

Elements of § 619 DFA

§ 619 DFA stipulates prohibitions on proprietary trading and certain relationships with hedge funds and private equity funds. "Banking entities" (insured depository institutions) and their holding companies, affiliates and subsidiaries are subject to restrictions with respect to engaging in certain types of proprietary trading and sponsoring or having any ownership interest in a hedge fund or private equity fund.

Proprietary trading

Proprietary trading means engaging – in principal – for the trading account of the covered banking entity in any purchase or sale of one or more covered financial positions (long, short, synthetic or other position in a security (including an option on a security) or a contract of sale of a commodity for future delivery or an option on a contract of sale of a commodity for future delivery).

Timeframe and extensions

Thus, § 619 DFA prohibits a "covered banking entity" from engaging in "proprietary trading" after 21 July 2014. But the Federal Reserve Bank (Fed) can provide a covered banking entity with up to three additional one year extensions if the proprietary trading activity is not based on illiquid funds and an additional extension of up to five additional years if the banking entity owns an illiquid fund or the ownership of the private equity fund or hedge fund is necessary to fulfil a contractual obligation of the banking entity that was in effect on 1 May 2010.

4. DFA Title VII

Product scope

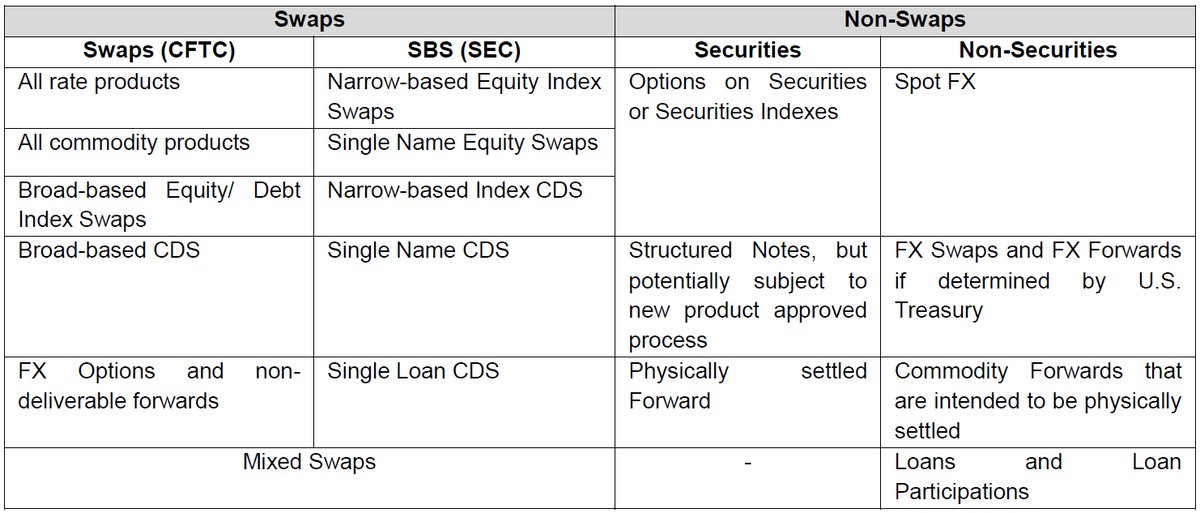

Title VII is the part of Dodd-Frank that deals with OTC-derivatives trading. All the trade-related obligations, such as mandatory clearing, reporting, margin and – in general – risk mitigation obligations are subject to DFA Title VII. To gain an understanding of the special terminology used in Dodd-Frank and specifically in Title VII is crucial for the analysis as to whether a – for instance – Swiss entity is covered by such act. Title VII distinguishes between swaps (subject to the CFTC jurisdiction) and security-based swaps (SBS) (subject to the SEC jurisdiction). "Mixed swaps", which are security-based swaps that are also based in part on one or more other swap variables, are subject to joint rulemaking of both the CFTC and the SEC (and the consultation of the Fed).

The definition of "security" in the US Securities Exchange Act of 1934 has been amended to include SBS.

Swap dealer is any person who

- holds himself out as a dealer in swaps;

- makes a market in swaps;

- regularly enters into swaps with counterparties in the ordinary course of business for his own account;

- is commonly known in the trade as a dealer or market maker.

Swap dealers need to be distinguished from Major swap participants (MSP). An MSP is any person (other than a swap dealer)

- who maintains a "substantial position" in a major swap category, excluding positions for hedging or mitigating commercial risk; or

- whose swaps create substantial counterparty exposure that could have serious adverse effects on the financial stability of the US banking system or financial market; or

- who is a financial entity that is highly leveraged relative to the capital it holds and is not subject to capital requirements established by a federal banking agency and maintains a "substantial position" in any major swap category.

End-users are non-financial entities that

- use swaps to hedge or mitigate commercial risk;

- notify the CFTC how they generally meet their financial obligations on non-cleared swaps;

- are end-user entities whose shares are publicly traded – they shall be required to obtain approval from the board of directors or the appropriate committee to use clearing exemptions.

And financial entities include the following:

- Swap dealers;

- MSPs;

- Commodity pools;

- Private funds;

- ERISA plans;

- Persons predominantly engaged in financial activities (i.e., insurance companies).

The category "other entities" (e.g., non-MSP Financial Entities) includes financial entities other than swap dealers/ MSPs and entities that would qualify for end-user exemption except for failure to satisfy hedging or notification condition.

5. Impact on Swiss financial institutions

The full impact of the Volcker Rule and DFA Title VII not only affects US entities but – potentially – also non-US entities, such as Swiss market participants. The Volcker Rule, for instance, applies to every foreign (and thus Swiss) entity that directly or indirectly maintains a bank branch or agency in the US or controls a commercial lending company in the US. And derivatives trading activities that have, inter alia, a direct and significant connection with activities in, or effect on, commerce of the US or contravene CFTC anti-evasion rules also submits foreign entities to its rules. Also, the presence of a guarantee or the qualification as an "affiliate conduit" for US-Persons could – and in most cases does – trigger the obligation to comply with Dodd-Frank. In turn, if a Swiss entity faces a non-US entity and engages in non-security-based swap activities outside the US, it does not fall under Dodd-Frank, unless (as mentioned above) the activities have a direct and significant connection with activities in, or effect on, US commerce; or the activities contravene any rules or regulations made by the CFTC to prevent evasion of any provision of the Commodity Exchange Act related to non-security-based swaps.

Equivalence may apply. Thus, in the case of certain parties and certain rules compliance with Switzerland's rules, it may satisfy CFTC / SEC in lieu of its own.

Due to the significant consequences that are triggered if a Swiss entity is subject to Dodd-Frank (and specifically the Volcker Rules and DFA Title VII), it is crucial to determine such potential applicability on a case-by-case basis at an early stage.